In brief

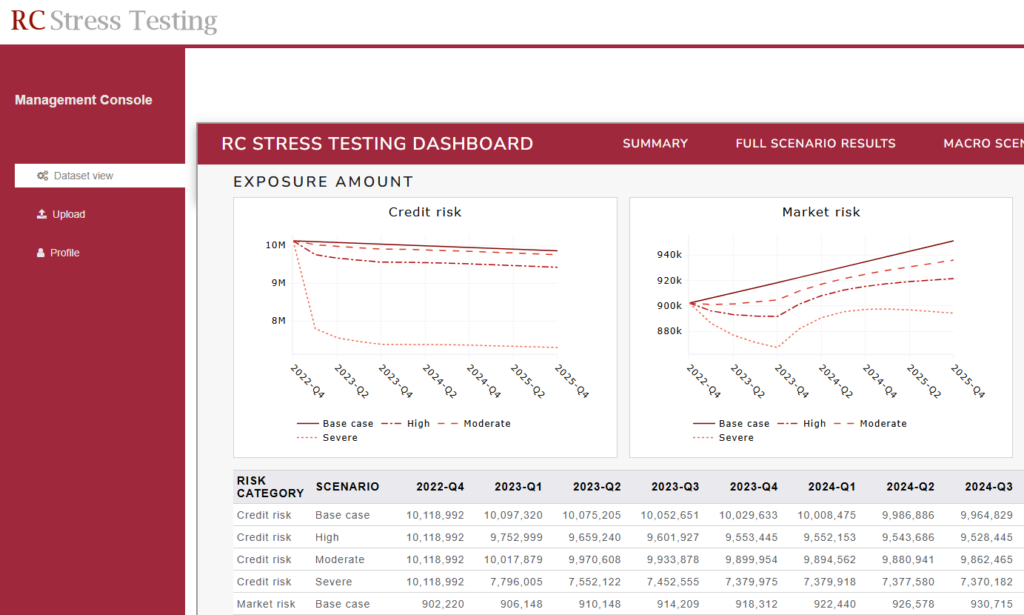

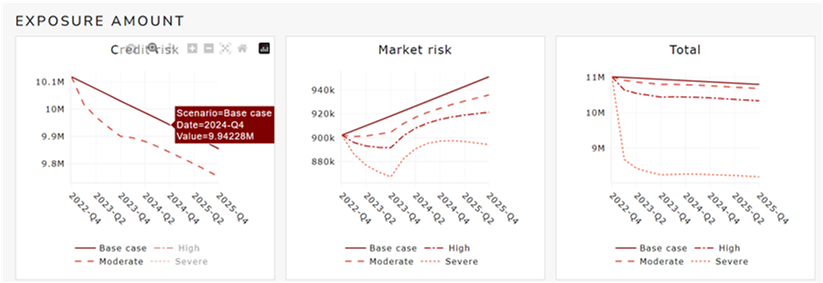

Risk Control’s RC-Stress Testing System provides a highly efficient, flexible and user-friendly framework for macro stress-testing.

It allows banks or other financial firms to analyse the impact of complex macroeconomic events on portfolios, capital requirements and provisions.

It permits macro-stress-testing analysis of banking and trading books and capital planning.

How it works

The model has an embedded statistical macroeconomic model in which scenarios may be created as deviations from a central forecast.

Routines provide current and projected capital measures and financial ratios based on bespoke modelling of the organisation’s financial statements.

A wide range of reports are available and additional reports may be constructed flexibly from downloads of intermediate results.

For more information, contact us.