In brief

RC-Operational Risk Capital Model provides Operational Risk specialists with a rigorous tool for computing capital. Inputs can either be scenario-based or historical-data-based.

The model provides OpRisk units in asset management firms, banks or insurers with a highly effective and flexible tools to analyse Risk Registers or historical loss data.

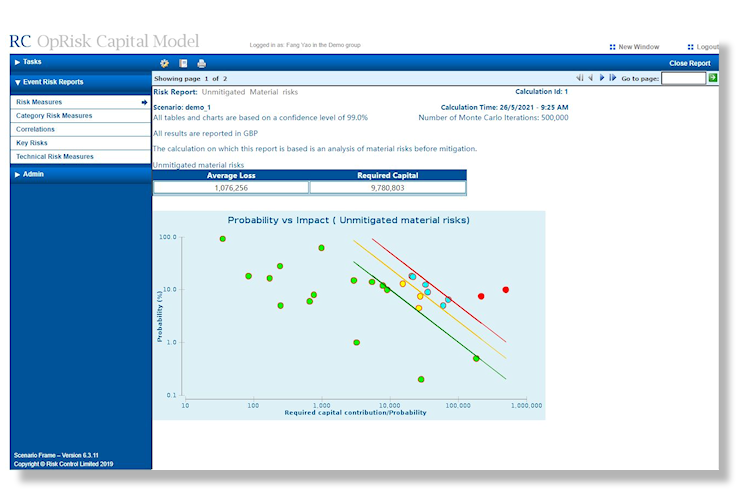

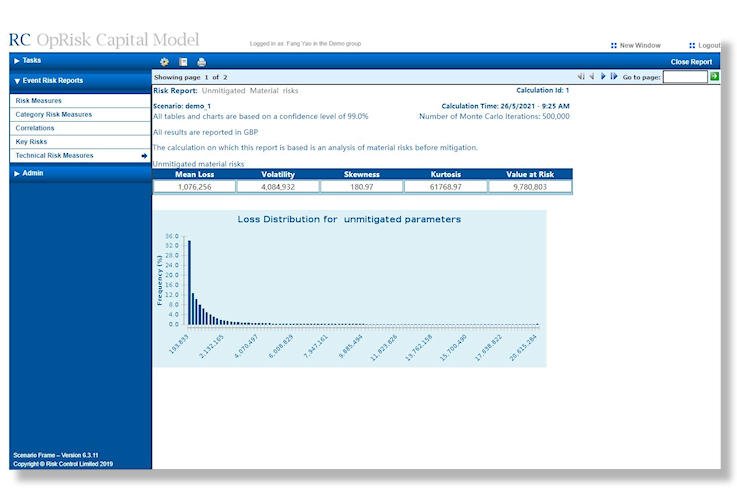

The framework supplies VaRs and Expected Shortfall capital at an aggregate level but also broken down to subsets of exposures. The model may be integrated with Risk and Control Self-Assessments (RCSA).

How it works

The model permits users to assign frequency and severity parameters to individual risks and then to choose among different modelling techniques to generate a capital computation.

The software may be operated by groups of individuals working on separate sets of risks, for example, for different legal entities.

The software provides an innovative and powerful way of deducing correlations between operational risks based on judgmental analysis.

For more information, contact us.